Are you considering Tripoint Lending for your debt consolidation needs? In this comprehensive tripoint lending reviews updated for 2024, we delve deep into the features, benefits, and drawbacks of Tripoint Lending to help you make an informed decision.

With consumer insights and expert analysis, discover if Tripoint Lending aligns with your financial goals and preferences.

Whether you’re seeking lower interest rates, simplified repayment terms, or improved financial management, this review aims to guide you towards the right choice for your financial journey.

Read on to explore whether Tripoint Lending is the ideal solution for consolidating your debt and achieving financial freedom.

Understanding Tripoint Lending

Tripoint Lending: An Overview

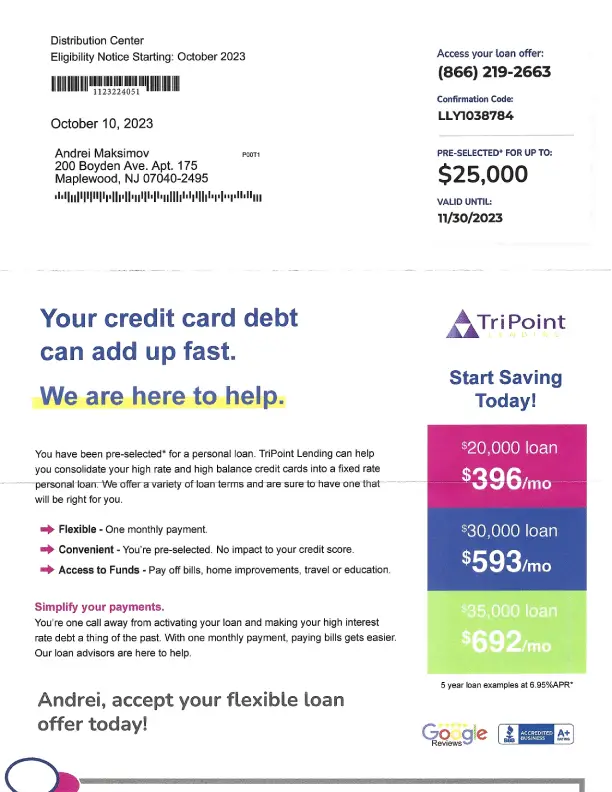

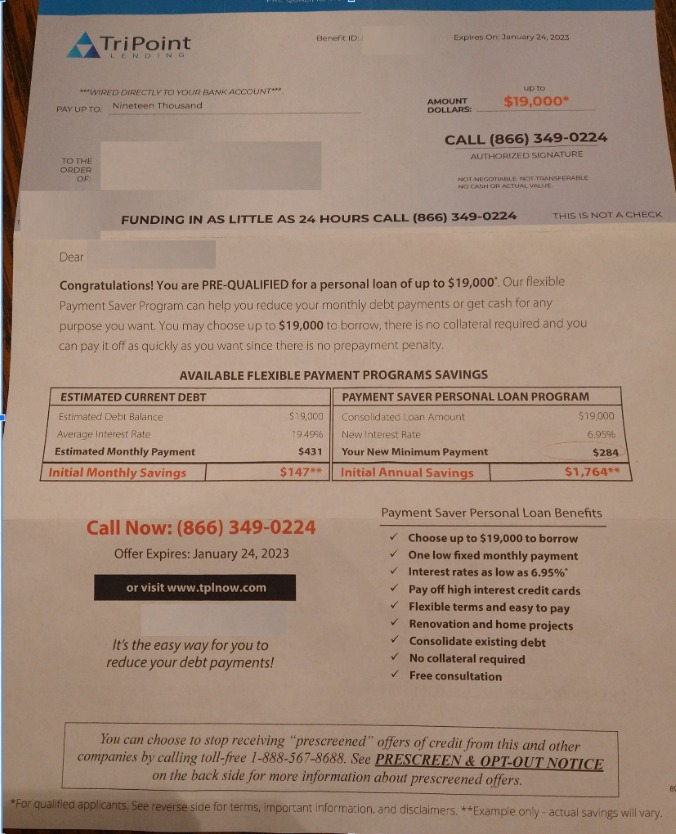

Tripoint Lending is a financial services company specialising in debt consolidation loans. With a focus on providing personalised solutions to individuals burdened by multiple debts, Tripoint aims to streamline repayment processes and help borrowers achieve financial freedom.

Tripoint Lending’s Loan Products and Services

Tripoint Lending offers a range of loan products tailored to suit different financial situations. From personal loans to debt consolidation loans with competitive interest rates and flexible repayment terms, Tripoint strives to accommodate diverse borrower needs.

Pros and Cons of Tripoint Lending

Pros of Tripoint Lending: What Sets it Apart?

- Competitive interest rates:

Tripoint Lending offers competitive interest rates compared to other lenders in the market, potentially resulting in lower monthly payments for borrowers.

- Streamlined application process:

Tripoint’s online application process is straightforward and user-friendly, making it easy for borrowers to apply for a loan from the comfort of their homes.

- Personalised customer service:

Tripoint Lending prides itself on providing personalised customer service, with dedicated loan specialists available to assist borrowers throughout the loan application and repayment process.

Cons of Tripoint Lending: Areas for Improvement

- Limited loan options:

While Tripoint Lending offers debt consolidation loans, its range of loan products may be limited compared to other lenders, potentially limiting borrower choices.

- Eligibility requirements:

Tripoint Lending may have stringent eligibility requirements for loan approval, making it challenging for some borrowers to qualify for a loan.

Is Tripoint Lending Right for You?

Assessing Your Financial Needs

Before deciding whether Tripoint Lending is the right debt consolidation loan provider for you, it’s essential to assess your financial situation and goals. Consider factors such as your current debt load, income, and credit score to determine whether Tripoint’s loan products align with your needs.

Comparing Tripoint Lending with Competitors

Exploring alternative lenders and comparing their offerings can help you make an informed decision about which debt consolidation loan provider is best suited to your needs. Consider factors such as interest rates, fees, and customer service when evaluating different lenders.

What Do Tripoint Lending Say?

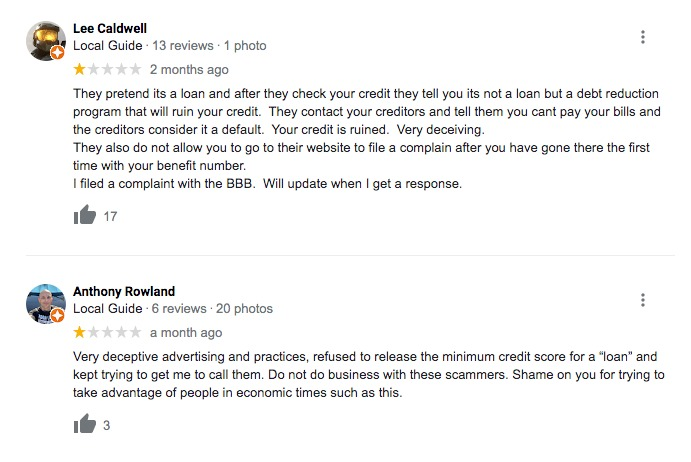

Tripoint Lending garners mixed reviews. While some customers praise their simplified process and reduced interest rates, others express concerns about aggressive sales tactics and unclear fees.

Here’s a breakdown of key review platforms:

- Google tripoint lending Reviews: 4.3 stars (positive bias likely due to removal process)

- Better Business Bureau: A+ rating, but 3.76 stars from customer reviews

- Trustpilot: 2.2 stars (mostly negative experiences)

Tripoint Lending Reviews: Customer Experiences

Customer experiences with Tripoint Lending give us a peek into how people feel about their services. Let’s take a look at what some customers have to say:

- 1. John’s Positive Experience:

- John shared that Tripoint Lending customer service was really helpful when he needed assistance with his loan application. He appreciated their friendliness and patience throughout the process.

- 2. Mary’s Smooth Process:

- Mary mentioned that she found Tripoint Lending online application process easy to follow. She liked how quickly she received a response and got approved for her loan.

Conclusion

In navigating the complex world of debt consolidation, Tripoint Lending emerged as a potential solution for those seeking financial stability and ease of repayment.

Our comprehensive review updated for 2024 has provided valuable insights into Tripoint Lending offerings, allowing you to make an informed decision about whether it aligns with your financial goals and preferences.

The streamlined application process and transparent communication regarding fees and charges are commendable aspects that cater to borrowers’ needs for clarity and efficiency.

However, it’s important to acknowledge that Tripoint Lending, like any financial institution, has its drawbacks. The limited range of loan options and stringent eligibility requirements may pose challenges for some borrowers, impacting their ability to access the desired financial assistance.

Whether Tripoint Lending are the ideal solution for consolidating your debt and achieving your financial goals depends on your unique circumstances and preferences.