In the fast-changing world of finance tech, FinTechZoom has been a go-to for many, offering tools to navigate the financial maze.

However, it’s smart to check out other options with the fintech scene always evolving.

In this review, we’ll explore the top five FinTechZoom alternatives in 2024, helping you compare and find what suits your financial needs best. Whether it’s better features, a different vibe, or specific functions you’re after, these alternatives might be just what you need.

Let’s take a stroll through the world of FinTech and discover what’s beyond FinTechZoom together.

What is FinTechZoom?

FinTechZoom is a versatile financial technology platform, providing users with a one-stop solution for navigating the complexities of modern finance.

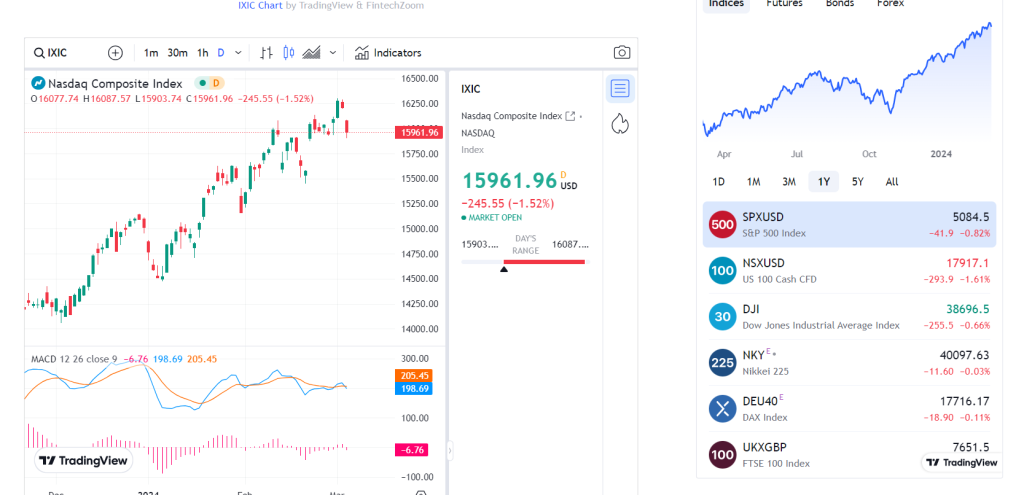

Offering real-time market updates, personalized insights, and a user-friendly interface, it caters to diverse financial needs, from budgeting to investment tracking. Leveraging advanced technologies like AI and machine learning, FinTechZoom ensures users stay ahead with cutting-edge tools.

As a dynamic player in the fintech arena, it excels in empowering individuals and businesses alike to manage their finances efficiently and stay abreast of the latest trends in the financial landscape.

Features of FinTechZoom

1. Comprehensive Financial Management:

FinTechZoom serves as a centralized platform for managing personal and business finances. Users can effortlessly track income, expenses, and investments, providing a holistic view of their financial landscape.

2. Real-Time Market Updates:

Stay informed with FinTechZoom’s real-time updates on market trends, stock prices, and financial news. This feature empowers users to make timely and well-informed decisions based on the latest information.

3. Intuitive User Interface:

Designed with user-friendliness in mind, FinTechZoom ensures a seamless experience for all users. The intuitive interface makes financial management accessible, even for individuals new to the world of finance.

4. Investment Tracking:

FinTechZoom enables users to monitor and analyze their investment portfolios efficiently. Gain valuable insights into performance and identify potential opportunities for growth.

5. Cutting-Edge Technologies:

Leveraging advanced technologies such as artificial intelligence and machine learning, FinTechZoom delivers personalized insights and optimizes financial strategies for users seeking a competitive edge.

6. Secure Transactions:

Emphasizing security, FinTechZoom employs robust encryption protocols to safeguard user data and financial transactions, providing peace of mind in an era of increasing cyber threats.

7. Budgeting Tools:

FinTechZoom offers powerful tools for creating and managing budgets. Users can set financial goals, track spending patterns, and work towards achieving a more secure financial future.

8. Customizable Alerts:

Tailor your financial experience with FinTechZoom’s customizable alerts. Stay informed about specific financial events, ensuring you never miss crucial updates that matter to you.

9. Expense Categorization:

Simplify financial tracking with FinTechZoom’s automated expense categorization. Easily understand your spending habits and gain insights into areas where adjustments can be made.

10. Mobile Accessibility:

FinTechZoom’s mobile apps provide users with the flexibility to manage their finances on the go. Accessible anytime, anywhere, these apps enhance convenience and ensure financial control is always within reach.

5 Best Alternatives of FinTechZoom

Mint

- Mint is also known for its user-friendly interface, Mint offers comprehensive financial management tools, including budgeting, expense tracking, and investment monitoring. It provides a holistic view of your financial health and suggests personalized insights.

Personal Capital

- Tailored for investors, Personal Capital combines budgeting features with robust investment tracking. It offers a free tool for analyzing your portfolio’s performance and provides financial advisors for more personalized guidance.

YNAB (You Need A Budget)

- YNAB focuses on proactive budgeting, helping users assign every dollar a specific job. With a commitment to financial discipline, YNAB emphasizes goal setting and expense prioritization.

Acorns

- Acorns simplifies investing by rounding up your everyday purchases and automatically investing the spare change. This micro-investment approach is ideal for those looking to start investing without substantial upfront commitments.

Robinhood

- Targeting both beginners and experienced investors, Robinhood offers commission-free trading for stocks, ETFs, options, and cryptocurrencies. Its straightforward platform is particularly popular among those seeking a no-frills investment experience.

Conclusion

In the fast-paced world of finance tech, FinTechZoom has been a reliable tool for many. However, with the financial tech scene always changing, it’s smart to explore other options. In this review, we’ve checked out the top five FinTechZoom alternatives in 2024. These alternatives – Mint, Personal Capital, YNAB, Acorns, and Robinhood – each bring something special to the table.

As we’ve walked through this comparison, it’s clear that the world of finance tech has options for everyone. Whether you want simplicity, advanced features, or a unique investment approach, these alternatives have you covered. So, as we wrap up, let’s embrace the possibilities beyond FinTechZoom, finding the best fit for your financial journey.